Fiserv Small Business Index for January 2025: Positive Start to the Year with Continued Sales Growth Across Key Sectors

Fiserv, a leading global provider of payments and financial services technology, has published its Small Business Index for January 2025. This latest report reveals a continuation of the positive trends seen in 2024, with small businesses starting the year with strong growth in sales and transactions. The seasonally adjusted Index for January stood at 147, reflecting a modest one-point increase from December. This increase is seen as a strong indicator that small businesses are entering the new year on a solid footing, building on the momentum generated during the previous holiday season.

A Positive Beginning for Small Businesses in 2025

For small businesses, the January performance marks a welcome sign of resilience as many were coming off a successful holiday season. The growth observed in January was particularly encouraging, as it indicates that consumers remain confident in spending, even after the holiday rush. Small businesses across various sectors experienced growth, with businesses in the services sector performing exceptionally well, while retailers and wholesalers also saw a rise in year-over-year sales, albeit at a slower pace.

However, not all sectors performed uniformly. While there was an uptick in foot traffic for restaurants, sales actually declined as consumers increasingly gravitated toward more budget-friendly dining options. Despite this, the overall outlook for small businesses remains optimistic, with growth continuing into the new year.

Small businesses saw continued growth in January, starting 2025 off on the right foot,” said Prasanna Dhore, Chief Data Officer at Fiserv. “While some sectors saw slower growth than others, the overall trend remains positive, and the increase in foot traffic for restaurants and retail is a good sign for the months ahead.

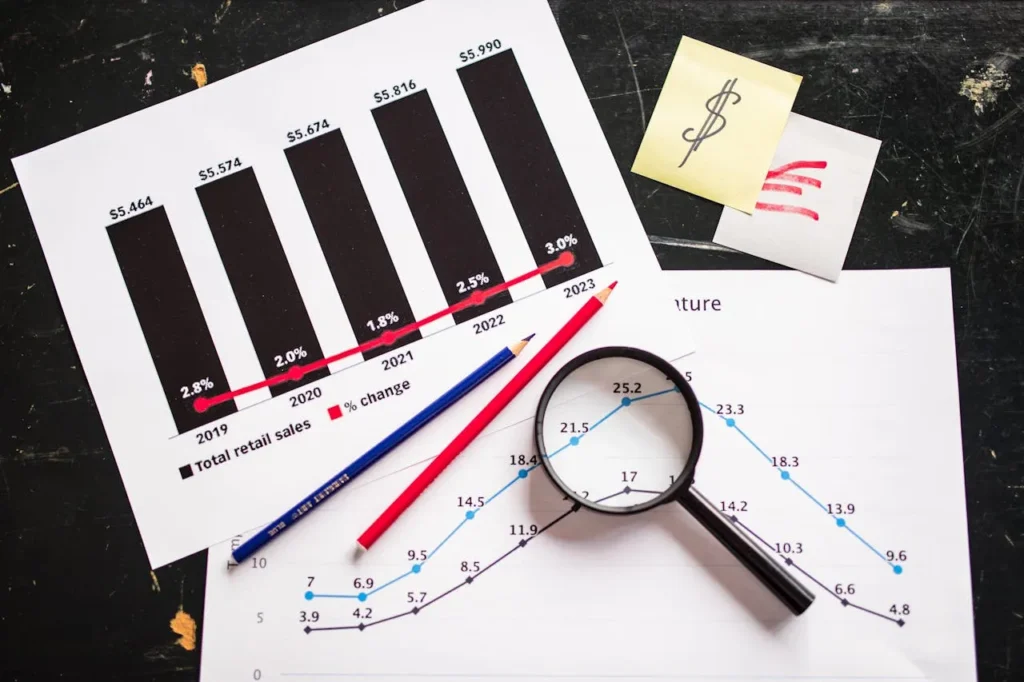

Year-Over-Year and Month-Over-Month Growth

On a year-over-year basis, small business sales showed a healthy increase of 5.1%, while total transactions grew by 6.5%. Both figures reflect a robust economic environment for small businesses, as consumers continue to invest in products and services. Month-over-month data also indicated growth, with sales up by 0.5% and transactions increasing by 1.3%. This consistent upward trajectory indicates that small businesses are adapting well to shifting consumer preferences and broader economic conditions.

Retail Sector Performance

In the retail sector, small businesses continued to experience solid growth, though the pace was somewhat slower compared to earlier in the holiday season. Year-over-year, retail sales increased by 4.1%, while transactions grew by 5.1%. However, average ticket sizes decreased by 1.0% compared to January 2024, signaling a shift toward more cost-conscious shopping behaviors.

Among the fastest-growing retail categories were General Merchandise, which saw an impressive 11.0% growth, followed by Grocery at 5.6%, and Building Materials, which grew by 4.5%. These sectors were particularly strong as consumers increasingly focused on essential and practical purchases.

On a monthly basis, small business retail sales grew by 0.2%, and transactions rose by 0.8%. However, average ticket sizes saw a slight dip of 0.6%. Building Materials (+1.9%), Gasoline Stations (+1.6%), and Grocery (+0.7%) were the strongest performers for month-over-month growth. Despite strong holiday season performance, some retail categories experienced a slowdown in January. Clothing (-3.4%), Furniture (-1.9%), Motor Vehicle Parts (-0.8%), and General Merchandise (-0.1%) all saw declines in their growth during the month.

Restaurant Sector Challenges

The restaurant sector presented a mixed picture in January 2025. While foot traffic to restaurants increased by 6.5% year over year, overall sales declined by 1.7%. The primary driver behind this decline was a reduction in average ticket sizes, which fell by 8.3% compared to the previous year. This shift is likely a result of inflationary pressures, with consumers opting for more affordable dining options in response to higher costs.

Month-over-month, restaurant sales declined by 1.3%, while transactions grew by 1.8%. This suggests that while more people were visiting restaurants, they were spending less per visit. The decline in average ticket sizes (-3.1%) further underscores the trend of consumers cutting back on spending.

Services Sector Growth

In contrast to the challenges faced by the restaurant industry, the services sector experienced robust growth in January. Sales for service-based small businesses increased by 5.5% year over year, and they also saw a modest increase of 0.8% on a month-over-month basis. As consumers shifted spending away from retail and restaurants, many directed more dollars toward service-based industries.

Within the services sector, several categories saw exceptional growth. Professional Services (+13.4%), Food Manufacturing (+12.5%), Religious, Civic, and Professional Organizations (+10.2%), and Truck Transportation (+8.7%) all posted strong year-over-year gains. These figures suggest that service-oriented businesses are thriving as demand for expertise and specialized services continues to rise.

When looking at month-over-month growth, Professional Services (+3.2%), Religious, Civic, and Professional Organizations (+2.5%), and Educational Services (+2.2%) were the top performers, showing strong demand and continued expansion.

Regional Performance Trends

Geographically, several states demonstrated significant year-over-year sales growth. Wisconsin led the way with a remarkable 13.9% increase, followed by Florida (+11.9%), Georgia (+11.5%), Virginia (+10.4%), and Minnesota (+9.0%). These states saw broad-based economic activity, with small businesses across various industries benefiting from a favorable climate for growth.

When looking at month-over-month performance, Maryland (+4.2%), Montana (+3.5%), and Iowa (+3.5%) experienced the strongest sales growth in January. These states are seeing continued demand for products and services, which bodes well for small businesses in the upcoming months.

In large cities, the trend was similarly positive. Atlanta, in particular, recorded the highest year-over-year growth among major cities, with a 14.3% increase in sales. Miami also posted strong gains, with sales increasing by 9.8%. On a month-over-month basis, Boston (+2.5%), Washington DC (+2.0%), and Philadelphia (+1.8%) showed the most notable growth in January.